PORT CITY NIDHI LIMITED

PEARL LIFE RECURRING DEPOSIT

As a low-risk investment option with higher returns than a regular Recurring deposit, Pearl Life Recurring Deposit (PLRD) is best suited for those customers who can deposit a certain share of their income to the RD every month for a long duration as a lock-in period. APLRD scheme allows the customers to earn fixed but high interests on the amount invested at frequent intervals until the tenure is complete. However,the customers to invest in this scheme for a longer duration of at least 36 months.

PORT CITY NIDHI LIMITED

INTEREST RATES

PEARL LIFE RECURRING DEPOSIT

PORT CITY NIDHI LIMITED

BENEFITS

Assured Higher Returns Than RD

As a minimal-risk investment, you will end up with substantial savings at the end of the tenure with interest returns much higher than your typical recurring deposit account.

Safe and Fixed Interest Rate

The interest on PLRD is calculated at a fixed rate for the entirety of its tenure which is higher than the typical RD interest rates. Your interest will be calculated at the fixed rate ensuring you don’t get impacted by any ups and downs in the market.

Fulfill Your Long-Term Financial Goals

With a Pearl Life Recurring Deposit scheme, you start making fixed monthly investments that are aimed towards achieving a long-term financial goal. It is most beneficial for salaried individuals whoget higher and assured returns under this scheme.

PORT CITY NIDHI LIMITED

DESCRIPTION

INTRODUCTION

Port City Nidhi has come up with the Pearl Life Recurring deposit plan for the convenience of those who can invest a small amount every month for a duration of 36 months. You can directly open a PLRD account with us and at the end of tenure, we will credit the maturity amount to your account in any bank FREE of charge. As the interest is compounded quarterly and is higher than the RD schemes, it will enable you to have substantial savings at the end of tenure.

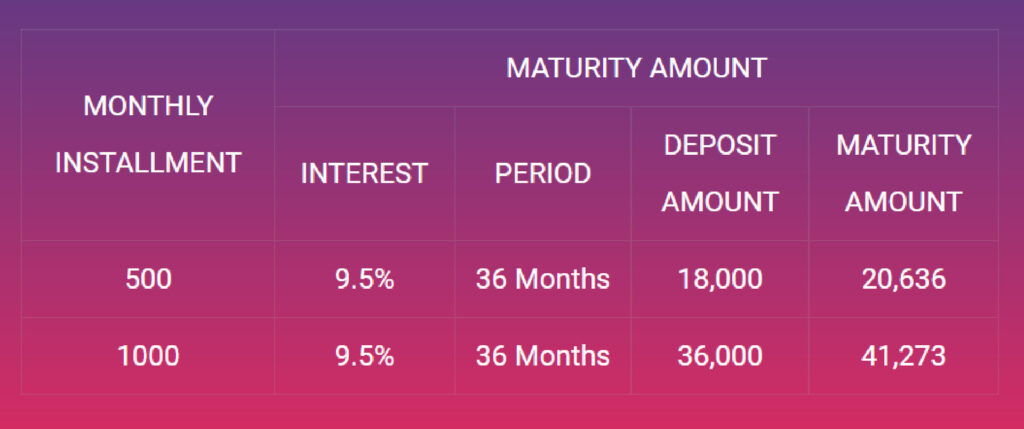

OUR PLANS

We offer the PLRD scheme for our members with the flexibility to opt for tenures of 36 months. With a monthly investment of as low as 500 rupees, you can build up on your savings and obtain long-term financial gains. These installments can be paid by cheque or through transfer from other bank accounts, and also cash.

PORT CITY NIDHI LIMITED

DOCUMENTS

IDENTITY PROOF

Aadhaar Card

PAN card

ADDRESS PROOF

Passport

PAN card

Voter ID card

Driving Licence

OTHERS

Passport Size Photos - 3

Bank Passbook Copy

Mobile Number

Nominee Proof

PORT CITY NIDHI LIMITED

FREQUENTLY ASKED QUESTIONS

The minimum deposit amount is 500 rupees.

Yes, you won’t be charged any TDS for interest amount up to 40,000 rupees p.a.

The charges and penalty of pre-closure of PLRDs are a little high as these investments are under a lock-in period. Please contact our customer support team to know more about the policy terms before investing.